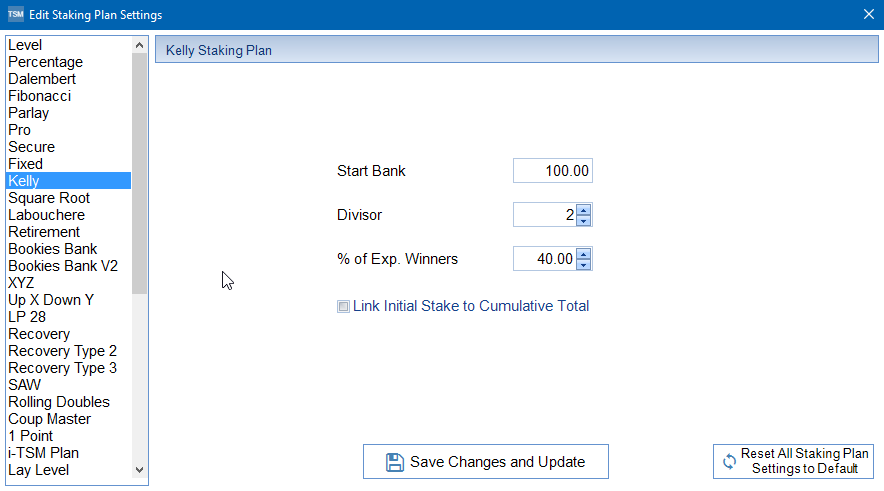

Kelly Staking Plan

The Kelly Staking Plan is based on using the ‘Kelly Constant’. Kelly Criteria was developed in 1956 by John L. Kelly. It was designed to maximize the growth of your bank-roll over the long term, by determining the optimal stake on a bet. The Kelly Criteria requires that your percentage-estimations (probabilities) are better than the bookmaker’s estimations. If you are confident that you can determine value to be on your side as opposed to that of the bookie, the following Kelly Criteria formula will tell you the optimal amount of your bank to bet.

There are many ways of writing this formula. For arguments sake the original format is showed here. One thing you MUST know is your probability of winning.

f* = bp – q / b

where f* is the fraction of the current bankroll to wager;

b is the current bet odds(fractional);

p is the probability of winning;

q is the probability of losing, which is 1 − p.

For example if your start bank = £100 and your current decimal odds are 5. You have done all your research and your probability of winning is 25% or 0.25.

Therefore f* = (((5-1)*0.25) – (1-0.25)) / (5-1) f* = 0.0625

Multiply this fraction by the start bank to find your stake;

Stake = 0.0625 * £100 = £6.25

The Kelly Criteria is popular with many professional bettors. Many others prefer not to use the Kelly Criteria as they deem it too risky, in that it requires a large number of percentage estimations. Even if you are good enough to find a large number of overrated ‘value’ bets, using the Kelly Criteria can still cost you money due to the resultant stake being too high. In an attempt to offset this problem, many supporters of the Kelly Criteria principle use a variation to the system called ‘Proportional Kelly’ which divides the percentage by a set number which helps minimise the risk.

If you ‘overestimate’ your ability to predict an outcome i.e. you predict a 60% chance, when the correct prediction should be 52%, you will pay for it by losing money. If on the other hand, you ‘underestimate’ your ability to predict the outcome i.e. you predict a 55% chance, when the real chance is 60%, you will win money with the Kelly Criteria. This is due to the fact that Kelly Criteria formula optimises your stakes providing you are able to predict with a high degree of accuracy.

With the Kelly Criteria you make money by having only a small advantage on every game you pick. If you instead have a small disadvantage for every game you pick as a result of overestimating your predictions, you will lose money with the Kelly Criteria as compared to flat stake betting.

In TSM we assume that EVERY BET in the selection system has the same edge.